Hi Frens,

as always, the market newsletter is split into two parts: Bitcoin outlook by Joseph Young and on-chain analysis by Cole.

The Bitcoin outlook

The market sentiment around Bitcoin is still overwhelmingly positive despite the abrupt overnight drop.

On Tuesday (January 5), Anthony Scaramucci, the White House Director of Communications, announced his hedge fund SkyBridge bought $300 million worth of Bitcoin from November to December 2020.

Institutions are continuing to show more interest in Bitcoin as an inflation hedge, and this is evident in the trading activity of key institutional trading platforms.

The open interest of the CME Bitcoin futures market remains the biggest in the world, surpassing Binance Futures and OKEx.

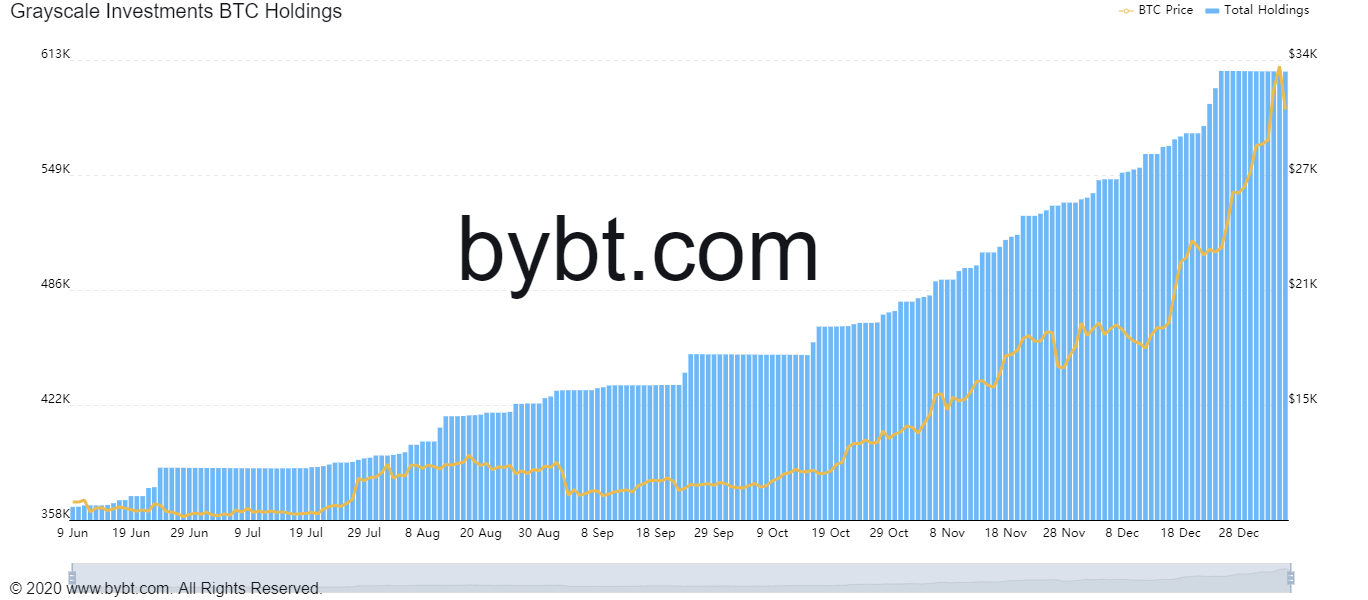

Grayscale now has $22.8 billion in assets under management, with $19.1 billion parked in the Grayscale Bitcoin Trust.

Grayscale is an important gauge of the institutional interest in Bitcoin. Unlike Canada, there is no Bitcoin exchange-traded fund (ETF) in the U.S.

The Grayscale Bitcoin Trust is the only alternative to a Bitcoin ETF that is available in the U.S.

Source: bybt.com

But, one flawed argument is that “institutions never sell” or “high net worth investors never sell.”

Bitcoin is up nearly 9-fold since the March crash and large investors who bought early on could take profit and rebalance their portfolios.

For example, DeVere Group CEO Nigel Green said he sold half of his Bitcoin holdings at $25,000.

Market analysis and forecast

Bitcoin sold off heavily yesterday and it dropped 16% in six hours.

Source: TradingView.com

Right before the drop, South Korea’s biggest exchange Bithumb saw a $100 million deposit.

I talked to several major fund managers in South Korea. They all agreed that it was probably a team of whales trying to arbitrage the Kimchi Premium.

Yesterday (January 4), Bitcoin was trading 5% higher in South Korea. Coincidentally, that is when $100 million was moved to Bithumb.

Bitcoin dropped quite hard down to $28,100 during the Asia session. But, as the U.S. came online, Bitcoin began to recover.

The Coinbase premium reappeared as Bitcoin began to recover, which is a good sign.

This means high-net-worth investors in the U.S. took advantage of the drop and began to buy Bitcoin.

I swing longed $29,113 yesterday, as I wrote on Twitter, but I closed it at $32,000.

Bitcoin’s fast recovery from $29,000 confirms that the momentum is too strong for a big correction to happen.

The Bitcoin futures market was very over-leveraged and overcrowded before the drop.

Now, the market is less overheated, as shown by the funding rates.

Source: Bybt.com

The Bitcoin futures funding rate is fee traders have to pay every 8 hours. If the market is dominated by longs or buyers, then buyers pay sellers a fee, and vice versa.

The funding rate normally averages at 0.01%. So the market is not as overheated as before.

So what do I see in the market?

Personally, I like to use 5-day, 10-day, and 20-day moving averages (MAs) on the 4-hour and daily candle chart to gauge market structure and momentum.

I think that Bitcoin has another go at the $34,300 resistance level eventually.

But, there is big selling pressure continuously coming from Asia. Hence, the range would likely be $29,500 to $34,300.

$34,300 is a resistance area because many sell orders are stacked up at that level.

Binance currently shows $34,300 to $34,500 as a big sell area.

Source: Material Indicators

What top traders think

Alex Wice: [Top trader on FTX leaderboard] shorted the top, said funding was too high. Probably closed.

Ki Young Ju: [CryptoQuant CEO] “The bull market isn't over and the funding rate seems to return back. So I just bought more $BTC and $ETH.”

Kyle Davies: [Three Arrows Capital co-founder] “$ETH shorters will be fried into a fatty bacon”

Bitcoin Jack: [Predicted $4k bottom, called $19k rally] “Spot bid is back up - speculators shorting again Idk - wild dynamics We probably return back to 34K, flush everyone once more and then go on a mindblowing rally.”

CL: [High ranking trader on Binance Futures leaderboard] “20% move a day, keep the mental stability away.”

Theta Seek: [High-profile options trader] Predicted the top. Said “Taking most of the profits on ETH, BTC and other longs here. Local top IMO” on Jan 3.

Light: [Well-recognized large-size trader] “Reset derivatives premium”

Market X-ray and on-chain analysis by Cole Petersen

The crypto market is entering an unprecedented growth phase, with Bitcoin leading the way as it plows through all supposed resistance levels and begins closing higher time-frame candles above key levels — like $30,000.

This growth is far different than that seen in year’s past, with a relative absence of retail mania signaling that individuals are not the main force backing this movement, but rather so-called “smart money” like institutions.

A dive into on-chain data supports this notion, and also provides some insights into the sustainability of this movement over several time frames.

Tracking the Ebb and Flow of Bitcoin Miners

As has been mentioned in previous editions of this newsletter, miners have immense influence over Bitcoin’s price action, making spikes in selling activity from these groups potentially dire for the cryptocurrency’s price action.

CryptoQuant data, however, shows that there have been no abnormal spikes in selling pressure from these groups. In fact, a closer look even shows a tempered decline from activity seen just a couple of months ago.

Source: CryptoQuant

The lack of any abnormally large spikes (which are typically seen once or twice each month) signals that miners aren’t too keen on offloading their BTC at the moment.

This is likely due to Bitcoin’s immense strength.

Let’s Go Whale Watching:

Whales naturally play a large role in guiding Bitcoin’s price action, and a look at the cryptocurrency’s Whale Map (courtesy of Whalemap.io) shows that BTC is currently trading at a pivotal price region.

The three short-term levels with significant whale activity are: $29,300, $32,200, and $32,900.

Source: Whalemap

BTC is currently trading between the latter two of these levels, making this a pivotal region that could offer serious insights into where the entire market will trend over a short to mid-term time frame.

Funding Rates Build Influence Over Bitcoin:

As Bitcoin’s price swings grow wilder and wilder, the derivatives market is playing a heightened role in market movements.

This may be the primary cause behind the immense volatility seen as of late, with BTC seeing multi-thousand dollar price swings on a daily basis.

Data from CryptoQuant indicates that funding swings in both directions are now providing directionality for swings.

For instance, aggregate positive funding for long positions spiked to one-year highs yesterday right before Bitcoin’s price nuked below $30,000.

Source: CryptoQuant

Going forward, traders ought to watch for drastic funding swings for insights into short-term price movements.

About Us:

Joseph Young is a cryptocurrency analyst who has been in the space since 2014. He contributes to Forbes, CoinTelegraph, and a host of other top crypto news sites. Over his 6+ years in the space, he has built countless connections with industry leaders and has amassed over 100,000 followers on Twitter.

Nick Chong is a passionate crypto researcher who specializes in identifying and extracting conclusions from trends within the rapidly emerging DeFi-space. He has been involved in the crypto markets since 2016, and sources deals for a Vancouver-based crypto venture fund.

Cole Petersen first learned about Bitcoin in 2013, and began working in the space in 2017. While on a gap year as a student at the University of California, Irvine, he now leads LINKPAD, a DAO-owned venture capital fund and does part-time work as an associate at BlockVenture.

Pepe of the Day:

Pepe the Frog has become the unofficial mascot of the crypto markets, so we feel it is only fitting to add a “Pepe of the Day” section highlighting only the finest and rarest Pepes.

Today’s featured Pepe: “The future of finance is run by green frogs and anime girls”

It look like I have to pay more attention to the funding rate levels, could have been a great short :) Always learning, great article guys!