Market recap 12/26/2020: Bitcoin hits ATH at $24.6k—what happens next?

Merry Christmas!

The market recap is a brief market update posted several times throughout the week. It is data-driven and I look primarily into exchange heatmaps, whale inflows, OTC flows, and whale clusters. - Joseph Young

The price of Bitcoin hit a new all-time high at $24,681 on Binance.

Previous market recaps identified $24,200 as the major sell wall on Bitfinex and other major exchanges.

I said in an earlier tweet that the ideal trade is to wait for a convincing breakout above $24,200, rather than trying to catch bottoms, if not for $23,000.

Bitcoin surpassed $24,200, so it is clearly in an uptrend and the outlook is bullish.

But there are several concerns.

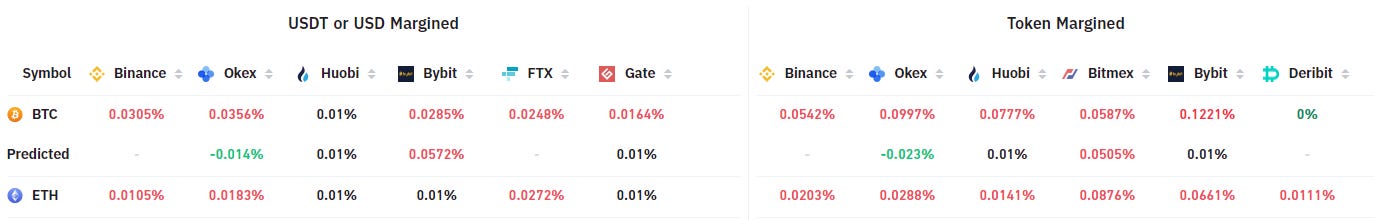

The futures funding rate - bearish

The funding rate is very high, which means the derivatives market is overheated.

Source: Bybt.com

The funding rate rises when there are more longs than shorts in the market. So when the funding rate, which averages at 0.01% rises to 0.1%, buyers have less incentive to long it.

The funding rate has come down a bit, but it’s still very high.

The major $24,200 exchange heatmap resistance breaks - bullish

The $24,200 level was a heavy sell area on Bitfinex and other major exchanges.

When Bitcoin broke this level and achieved a new all-time high, it meant the trend shifted to the upside.

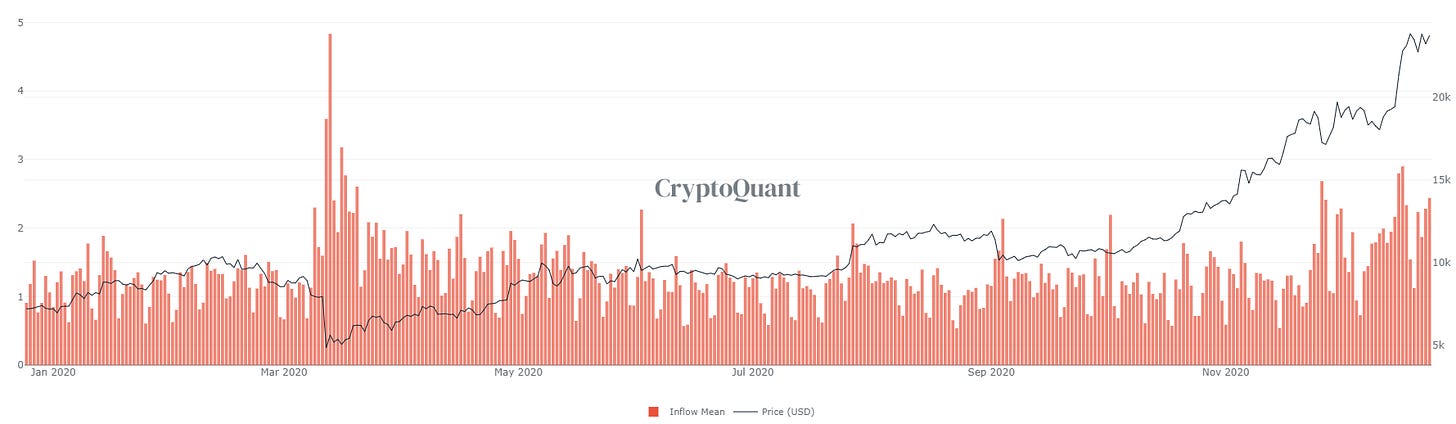

Whale inflows still remain at historic highs - slightly bearish

Whale inflows are useful to gauge the selling pressure in the market.

Source: CryptoQuant

Historically, when the All Exchanges Mean hit 2, it triggered corrections. It’s currently at 2.4.

So what do I expect?

I have been long Bitcoin since $18,560.

The reason why I have not closed the position is because I did not see any reason to do so.

I don’t see a big drop happening anytime soon. $23,000 has become a big support level.

During a bull market, the funding rate alone is not enough to cause a correction. If there are spot buys and institutional accumulation, then that can offset the high funding.

So, due to the high funding rate and high whale inflows, I expect Bitcoin to range between $24,600 and $23,600, eventually establishing $24,200 as support.

Exchange heatmaps also show $24.6k as a big sell area still, as shown below.

Source: Material Indicators

This will give enough time for the funding rates to reset and prepare another uptrend.

This is boring, but BTC is at a key level where it is likely to see a staircase rally, claiming one level after another.

I also think this is bad for large-cap altcoins in the interim.

When Bitcoin gets into this cycle, altcoins fall a lot harder than Bitcoin when BTC drops. But, when Bitcoin increases, altcoins lag behind.