DeFi Update: I'm DeFinitely buying the dip

Welp… hey guys! Nick here.

Errr… it’s been quite volatile over the past few days. I’d be lying if I said I haven’t been catching a bit less sleep due to the volatility. But the future of France has not changed! In my humble opinion, DeFi remains on a path of growth—the development and innovation that can be seen across the space is just a testament to that.

Before we get into it, I forgot to mention that we do have a pretty exciting interview coming up for our subscribers. We’ve been working to get it coordinated on our end, though our interviewee has been quite busy. We aspire to release that this upcoming week, so make sure you’re subscribed.

As a reminder (sorry for the plug), f you want access to the exclusive interviews with top traders and industry executives, our research about DeFi and crypto trends, and the additional DeFi letter, you will need to subscribe. But have no fear, it’s only $14.99 a month, or $139.99 a year.

$139.99 is coincidentally how much it cost me to make one Uniswap transaction last night. I think there’s more alpha in getting this newsletter than swapping on Sushiswap when the gas price is 500 Gwei, but that’s just me.

I have one word to describe the market over the past 96 hours: bloodbath.

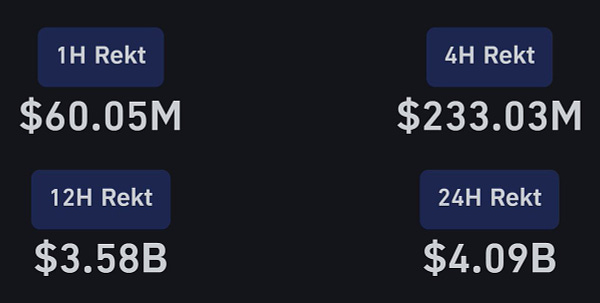

As I tweeted out at one point on Wed., there was over $4.1 billion worth of crypto futures positions liquidated in one 24-hour period. This morning, I checked the same site where I got this data (bybt), and it was even worse at around $6 billion worth of futures positions liquidated.

For context, according to bybt, there was approximately $5 billion worth of open interest in the entire crypto market on the day before Black Thursday.

To me, this was the flush we always needed. I try not to get too caught up in short-term trends but a prevailing trend of the past eight weeks was an extremely euphoric market marked by traders paying annualized rates of 100-300% to be long on certain digital assets, from Bitcoin and Ethereum to obscure altcoins.

The market has finally punished the late-longers, and as a result, we saw this rapid volatility as longs cascaded.

For my own personal portfolio, I picked up some DeFi coins on the dip.

As a general comment, with most smaller, early-stage DeFi coins that are not listed against any U.S. dollar pairs, market corrections represent a period to buy. Because these DeFi coins often have their base pair (the pair with most liquidity) AGAINST ether, when investors want to sell these tokens, they must sell it into ETH, then into another asset.

This creates especially reflexive periods, where selling begets selling, though if you have the cajones for it, the time to buy is often then, not when the market is extremely euphoric.

Despite the bloodbath, things are actually looking alright for DeFi.

According to my friends over at CoinGecko, top DeFi coins like UNI and SUSHI are “only” down by 12~15% in the past week, which isn’t too bad considering that Ethereum is down around 30% from its all-time high at $2,040.

There are a few coins that have largely been spared by the drop, though. In fact, some DeFi (DeFi-related) tokens this past week hit new all-time highs, largely unfazed by the volatility in bitcoin and ethereum.

To name a few outperformers and explain some of those trends:

Fantom: FTM has been surging higher as the smart contract platform has begun getting utilized more by Andre Cronje, the founder of Yearn.finance who used to actually work as a Fantom developer. Fantom has its own version of Curve, and it appears that Yearn may launch vaults or other products in that ecosystem as well as the search for scalable blockchains and other networks come into play amid high Ethereum gas fees.

DODO: DODO surged late last week as new life was infused into alternative decentralized exchanges that use different models than the x * y = k model that bought Uniswap and SushiSwap use. It is my belief that the much-publicized $100 billion implied valuation that Coinbase traded at in secondary markets caused some sort of infusion into the value of AMMs.

THORChain: While Binance Smart Chain has yet to prove itself as a viable Ethereum “alternative,” these past two weeks marked a decisive shift in the sentiment that DeFi users have over the multi-chain future. THORChain, which may act as a bridge for this multi-chain future, has benefited from this narrative playing out. Multicoin Capital also announced a large position in the asset.

What I’m keeping an eye on this week

While I love Ethereum and will continue to love it, I’m keeping an eye on other layer-ones and second-layer scaling solutions this week.

I was messing around with Polygon, which has been a pretty smooth experience thus far.

Polygon’s bridge kind of scares me though, as do all blockchain bridges. What if funds got stuck?

I actually ran into that issue when it took a bit of a while (20 seconds thereabouts) for Polygon to send tx data to my hardware wallet. I’ve noticed that for older hardware wallet devices, this is an issue. Maybe I should upgrade.

Another scaling solution I’m pretty excited about is Optimistic Ethereum by the Optimism team.

The firm revealed that it closed a round led by a16z, with help from firms like Paradigm.

The launch of this much-hyped solution is expected to take place in March of this year.

Disclaimer: This author is an analyst at ParaFi Capital. ParaFi Capital may hold positions in assets mentioned in this article. The views displayed in this article are opinions of the author—and the author only. This report should not be construed as investment advice. This author is not a financial advisor.