Hi Frens,

as always, the newsletter is split into three parts: Bitcoin outlook by Joseph Young, DeFi recap by Nick Chong, and on-chain analysis by Cole.

Tl;dr:

Bitcoin hit $23,800 across major exchanges, establishing a new all-time high.

Stablecoin inflows are spiking, indicating sidelined capital is entering the market.

Institutions are continuing to allocate a fraction of their portfolios into Bitcoin.

Traders are seemingly optimistic in general, with some anticipating some cautiousness in the short term.

Financial institutions and conglomerates in Asia are also beginning to welcome crypto.

Miner flows into exchanges are declining, indicating lower selling pressure.

Whale inflows are still high, but institutional accumulation could offset it, like the past few weeks.

DeFi tokens are rallying in tandem with Bitcoin. The biggest winner has been SushiSwap (SUSHI).

Nick Chong pinpoints Tranches as the trend to watch within the DeFi space this week.

On-chain analysis shows Three Arrows Capital has sent approximately 200 YFI to exchanges (FTX and Binance) over the past week.

Bitcoin Outlook by Joseph Young

The price of Bitcoin surpassed $20,000 for the first time since December 2017 and quickly rallied to above $23,000. The market sentiment around crypto is at euphoric levels, particularly as the institutional demand for Bitcoin intensifies.

There are three crucial ongoing trends in the Bitcoin market.

First, institutions are increasingly publicizing their investments in Bitcoin. Most recently, on December 17, Bloomberg reported that One River Asset Management, a hedge fund that focuses on volatility bets, already accumulated $600 million worth of cryptocurrencies.

By early 2021, the hedge fund plans to bring its total Bitcoin and Ethereum holdings to a staggering $1 billion.

Second, more banks and financial institutions are moving to support crypto. Last week, reports surfaced that BBVA would soon launch a crypto trading desk. BBVA is the largest bank in Europe, and this signifies the exponential growth in Bitcoin adoption and infrastructure.

Third, the trading activity in the Bitcoin market is noticeably shifting from retail players to institutions. For instance, data from Skew shows that CME is the third-biggest futures Bitcoin exchange by open interest, just behind OKEx and Binance Futures.

Source: Skew

News Recap

Ruffer Investment Group purchases 45,000 BTC, worth $938.25 million at the price of $20,850 per BTC.

CME announces Ether futures contracts

MassMutual buys $100 million worth of bitcoin.

Grayscale hits $13 billion in assets under management. This is significant because the Grayscale Bitcoin Trust is the go-to investment vehicle for institutions in the U.S.

Market Analysis

When the price of Bitcoin surpassed $20,000, it entered price discovery. The term price discovery refers to a trend where an asset surpasses its all-time high and looks for a new ceiling.

Bitcoin’s price spike occurred right as the stablecoin inflow into exchanges increased. Considering that investors within the crypto sphere primarily hold their capital in stablecoins, this trend shows that an influx of sidelined capital entered the cryptocurrency exchange market quickly, in a short period.

Source: CryptoQuant

As Bitcoin broke $20,000, this caused the price of Bitcoin to rally swiftly to above $23,000 across major exchanges.

Following Bitcoin’s breach of the all-time high, the market sentiment remains divided. Some are calling for a short-term top, due to the $24,000 level acting as resistance on exchange heatmaps.

What Popular Bitcoin Traders are Saying / Thinking in the Short Term:

Alex Wice: [Top trader on FTX leaderboard] “Alright, it's time. Up only.”

Ki Young Ju: [CryptoQuant CEO] Large stablecoin deposits, break of $20k bullish.

Kyle Davies: [Three Arrows Capital co-founder] “When $BTC hits $36k, bears will emerge again calling for dips.”

Peter Brandt: [Futures trader since 1975] “New highs are always a good indicator of healthy bull trend, but other than that the new highs mean very little of technical significance.”

Bitcoin Jack: [Predicted $4k bottom, called $19k rally] Breach of $19.6k invalidates bearish / hedge bias

CL: [High ranking trader on Binance Futures leaderboard] $425 million shorts liquidated, short-sellers in trouble

Theta Seek: [High-profile options trader] Optimistic, says “Dear Seller, Good luck.” Expects $50k by year end.

Light: [Well-recognized large-size trader] “Playing for a crash here is a high-risk low reward play.”

Crypto in Asia

China is aggressively expanding the testing of digital yuan. Reports revealed that individuals in Suzhou are using the digital yuan to transact online.

Singapore’s biggest bank DBS is launching a cryptocurrency exchange. This brings stability into Singapore and Asia’s cryptocurrency exchange market and it also sets a precedent for the broader financial sector. Crypto has struggled to deal with the barriers to financial and banking services for many years. The adoption of cryptocurrencies by major banks reduces friction over the long run.

Hanwha, one of the largest insurance conglomerates in South Korea, is hosting a blockchain and AI conference. Most conglomerates in South Korea, as seen with the likes of Samsung, LG, and Kakao, are involved with crypto and blockchain technology in some capacity. These initiatives show the confidence of large-scale corporations towards the sustainability of crypto and the blockchain.

Market X-Ray by Cole Petersen

As the Bitcoin bull run heats up, the players driving the market are beginning to change, with retail capital taking a back seat as institutions, funds, and other forms of so-called “smart money” begin foraying into the market.

Trying to map the movements of these players can be a daunting task, but data like over-the-counter (OTC) trading activity can shed some light on who is moving in the shadows.

While large players accumulate and back the growth seen by BTC in recent months, one active threat to Bitcoin’s buying pressure is miners, who wield massive holdings that could create a local (or even long-term) top.

Tracking the Ebb and Flow of Bitcoin Miners

Miners play an integral role in the crypto markets. Not only do they provide the hash power that underlies the entire Bitcoin network, but the BTC they produce in return for validating transactions can move markets and mark tops.

Let’s take a dive into what miners are doing with their Bitcoin holdings.

Miner Outflows to Exchanges Wane as Bitcoin Bull Run Heats Up:

Data from analytics platform CryptoQuant reveals an interesting, and undoubtedly bullish, trend regarding miner outflows to exchanges. As seen on the below chart, there have been three periods throughout 2020 that had sustained upticks in miner outflows to exchanges — January, March through May, and early-November.

Fortunately for bulls, the rate at which miners are sending their holdings to exchanges is beginning to taper. This may alleviate some of the pressure placed on the market and give Bitcoin room to rally higher.

Source: CryptoQuant

Let’s Go Whale Watching:

Compared to traditional markets that are flush with trillions of dollars, Bitcoin still remains a relatively small market, making large traders — sometimes known as “whales” — particularly impactful to its trading dynamics.

With BTC entering uncharted waters as its price holds above $20,000, the Map of Unspent Bitcoins (courtesy of Whalemap) reveals that there are three key levels near-term that large traders (defined on this chart as those with over 10,000 BTC) are currently placing bids at:

$19,150

$18,850

$18,060

It’s still too early to say with any confidence whether these traders will begin shifting their bids towards $20,000, conducting what is often referred to as a “support-resistance” flip. This would open the gates for it to see further upside in the mid-term.

Source: Whalemap

OTC Analysis: What the Order Books Aren’t Showing

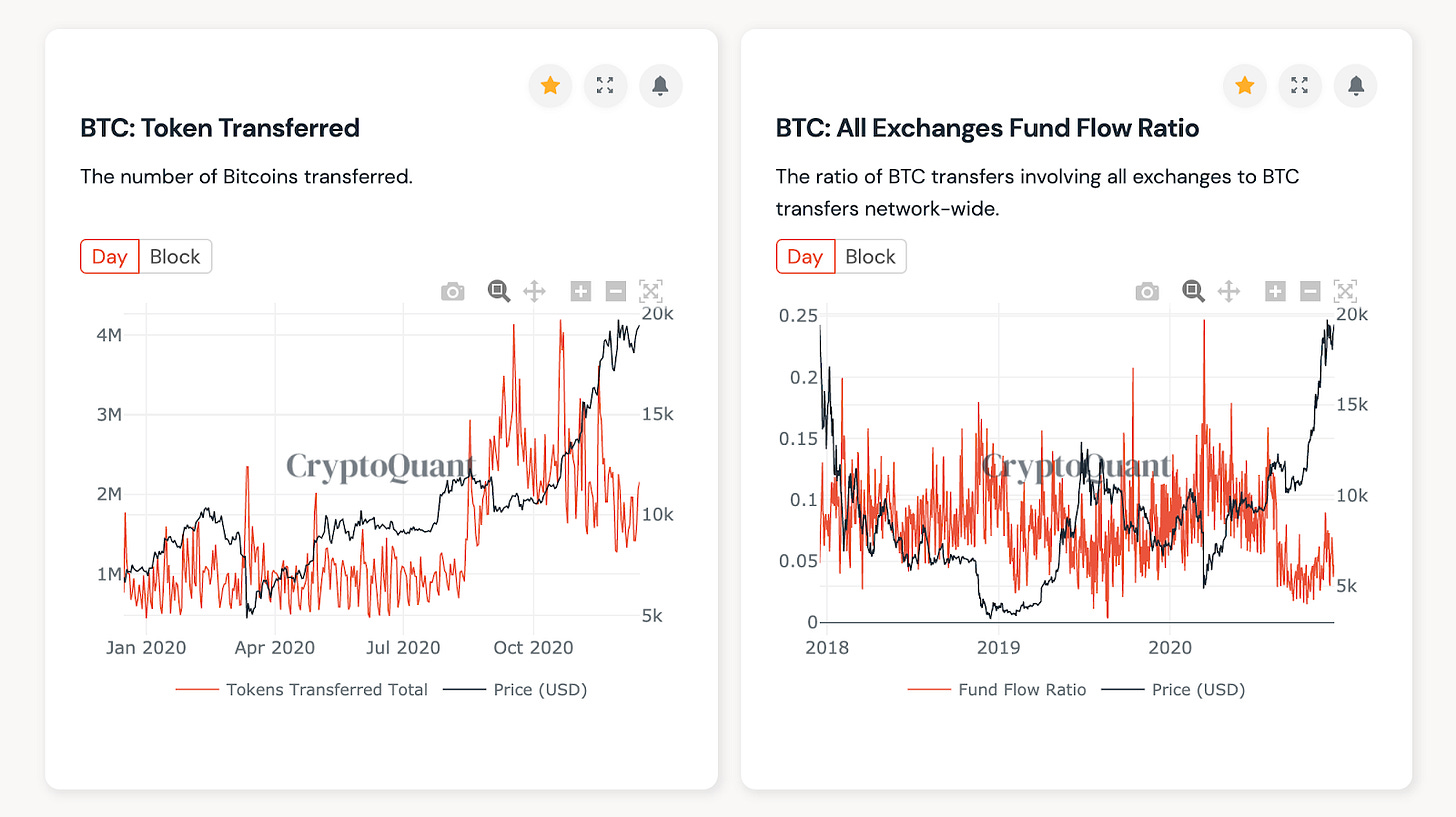

There’s no sure-fire way to accurately track and quantify over-the-counter trading flows, but you can gain a general idea by comparing the quantity of Bitcoin being transferred on-chain to the crypto’s “Exchange Fund Flow Ratio.”

When there’s a striking rise in on-chain transfers seen in tandem with a decline (or stagnation) of on-exchange transfers, it is typically viewed as a sign of heightened OTC flows.

This was a trend seen in September of this year, as pointed out by CryptoQuant CEO Ki Young Ju, who said at the time:

“The number of BTC transferred hits the year-high, and those TXs are not from exchanges. Fund Flow Ratio of all exchanges hits the year-low. Something's happening. Possibly OTC deals.”

Source: CryptoQuant

Now, compare the striking divergence between these two indicators in September with that seen presently, and it does not seem like there is any abundance of over-the-counter deal flow currently taking place.

Source: CryptoQuant

DeFi by Nick Chong

DeFi Recap (Top News)

While bitcoin is breaking out to new all-time highs as I write this, top coins in the decentralized finance space have underperformed this past week. While BTC is up 13.5% in the past seven days, top DeFi names like YFI, UNI, and AAVE are only up by 5-8%.

I pin this underperformance to a mean reversion for the rest of the market.

Decentralized finance coins were the first to rebound during the altcoin bottom in October and early November. Within days from the bottom, coins like YFI and SUSHI were up over 100%. At the time, 2017-era coins such as XVG, XRP, etc. had barely budged off their lows.

Some DeFi coins managed to stand out this past week, though.

SushiSWAP’s native SUSHI token was a big winner. Up 35% in the past seven days alone, the coin is benefiting from three things:

First and foremost, Yearn.finance announced a merger with SushiSwap late last month. This partnership allows the teams behind these projects to realize synergies and work toward new products such as Deriswap, an all-in-one platform for exchange, derivatives, and loaning.

Secondly, SUSHI is rumored to be on track to release a series of new products. One of these is “BentoBox,” which will be a money market solution allowing traders to go margin short on any supported pair.

Lastly, co-founder “0xMaki” hinted this week that SushiSwap will be “opening its doors” on Polkadot. Polkadot is the fastest growing smart contract ecosystem aside from Ethereum.

Chart of SUSHI’s price action over the past week. Source: TradingView.com

The chads over at DeFiance Capital summed up Sushi’s story and outlook quite well in a recent post for Deribit Insights, linked here.

Another winner is Bancor’s BNT token. Bancor is an Ethereum-based decentralized exchange that launched a bit too early, back when DeFi wasn’t even a term that existed.

BNT has gained 67% this past week after Coinbase Pro revealed that it would be adding the cryptocurrency, alongside AAVE and Synthteix’s SNX.

What I’m Watching This Week

This week, I’m keeping my eye on tranched DeFi products.

Tranches are a traditional finance concept whereby financial vehicles (often bonds or mortgages) are segmented by risk and maturity dates, then marketed to investors with different risk appetites and needs.

I won’t get into the weeds too much but the idea here is that investors can invest in tranches that are tailored to their risk preferences.

With DeFi still nascent, with a number of risks (smart contract risk, regulatory risk, volatility risk, etc.), I think tranches will be essential in attracting risk-averse investors to this nascent ecosystem.

Leading the tranched DeFi product charge is Saffron Finance and BarnBridge.

Saffron released the first tranched DeFi product in November, which allows users to supply liquidity in the form of DAI to Compound.

Holders of the senior tranche, the “S” tranche, get first claim on the capital if there is a bug. Holders of the junior tranche, the “A” tranche, are the last to claim funds if there is a bug. What makes this interesting is that those in the A tranche can obtain much higher yields than those in the S tranche—it’s just a matter of what your risk preferences are.

BarnBridge is on track to release its tranched products early next year.

What I’m excited about is their tranched volatility products. Senior tranche holders can obtain exposure to cryptocurrencies with less volatility risk than junior tranche holders. In a way, it’s similar to leverage.

What makes DeFi tranches so exciting is the autonomous nature of these contracts, which allows fees to be reduced across the board, improving yields.

Term of the Week: Aave

To many, decentralized finance remains a foreign subject punctuated by jargon and a ton of documentation. I’ll do my best every week to quickly break down one term or protocol in the DeFi space. If there’s something you want me to cover, ping me on Twitter!

Aave is a money-market protocol where users can borrow and lend a wide variety of digital assets.

Those that lend capital can earn a regular yield on their capital or can opt to borrow funds from the platform to be used in decentralized finance, on exchanges, or otherwise.

For instance, if someone has ethereum but no stablecoins, they can deposit their ethereum onto Aave and take a loan in stablecoins. Those stablecoins can then be used in the DeFi space to generate a yield, giving the investor passive income while maintaining their exposure to ethereum.

Watching Whale Addresses in DeFi

Now let’s go whale watching.

Looking over the addresses I regularly track, I noticed that addresses seemingly affiliated with Three Arrows Capital have sent approximately 200 YFI to exchanges (FTX and Binance) over the past week.

Frankly, I have no clue what that YFI was used for. It would be scary if I did. But one guess is 3AC could have swapped that YFI for bitcoin: over recent months, both 3AC co-founders Su Zhu and Kyle Davies have been eerily accurate in calling for altcoin vs. bitcoin cycles.

Of note, an address linked to 3AC via a network of proxy addresses still holds 600 YFI. So there’s that, too.

It’s becoming increasingly difficult to track some of these players as the web of addresses becomes increasingly complicated. But I’ll do my best.

If you enjoyed our first edition and want to hear more from us, please consider subscribing! It’s $14.99 a month for exclusive interviews, on-chain analysis, and unique data from top sources in the space. Alternatively, it’s $139.99 a year.

Get yourself a Christmas gift a bit early and subscribe to Alpha Alarm.

About Us:

Joseph Young is a cryptocurrency analyst who has been in the space since 2014. He contributes to Forbes, CoinTelegraph, and a host of other top crypto news sites. Over his 6+ years in the space, he has built countless connections with industry leaders and has amassed over 100,000 followers on Twitter.

Nick Chong is a passionate crypto researcher who specializes in identifying and extracting conclusions from trends within the rapidly emerging DeFi-space. He has been involved in the crypto markets since 2016, and sources deals for a Vancouver-based crypto venture fund.

Cole Petersen first learned about Bitcoin in 2013, and began working in the space in 2017. While on a gap year as a student at the University of California, Irvine, He now leads a DAO-owned venture capital fund and does part-time work as an associate at BlockVenture.

Pepe of the Day:

Pepe the Frog has become the unofficial mascot of the crypto markets, so we feel it is only fitting to add a “Pepe of the Day” section highlighting only the finest and rarest Pepes.

Today’s featured Pepe: “Galaxy Pepe in Awe of Bitcoin,” Colorized, Artist Unknown, 2020.

Clean and thoughtful, great first post! Subscribed :)

Pretty solid first post. Getting spoonfed this kind of info for $15/mo is a no brainer to me. Subscribed